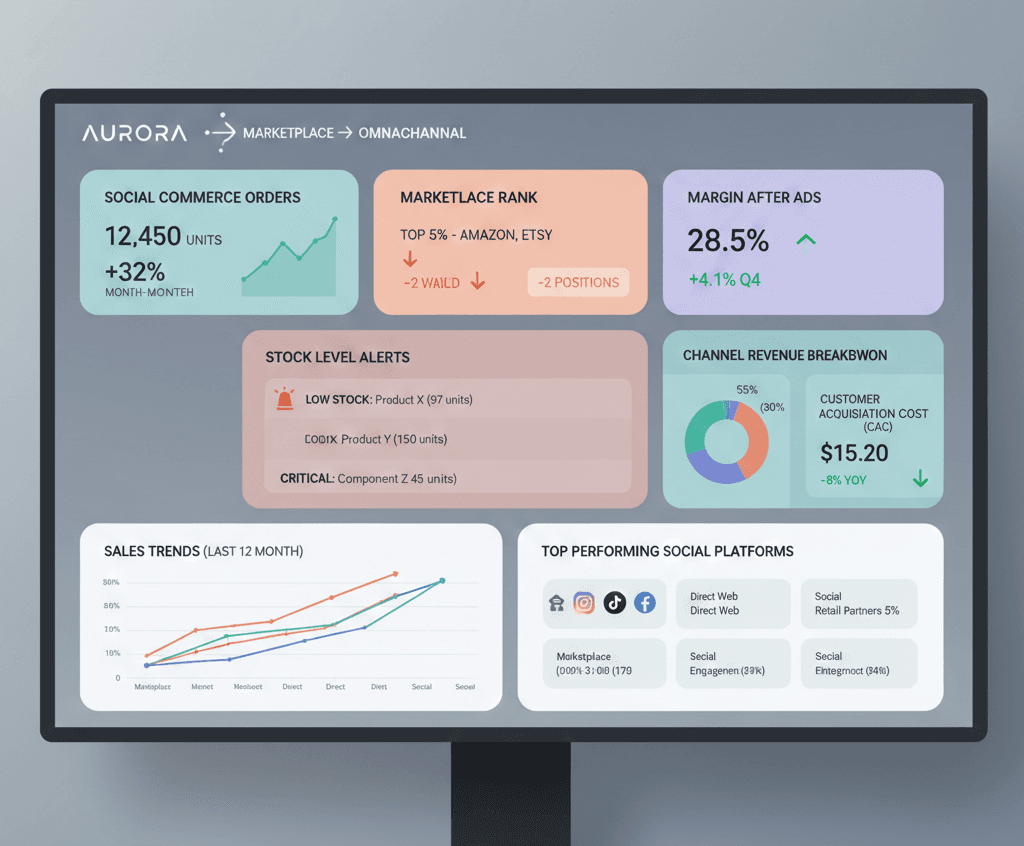

Why social commerce belongs in your 2026 plan

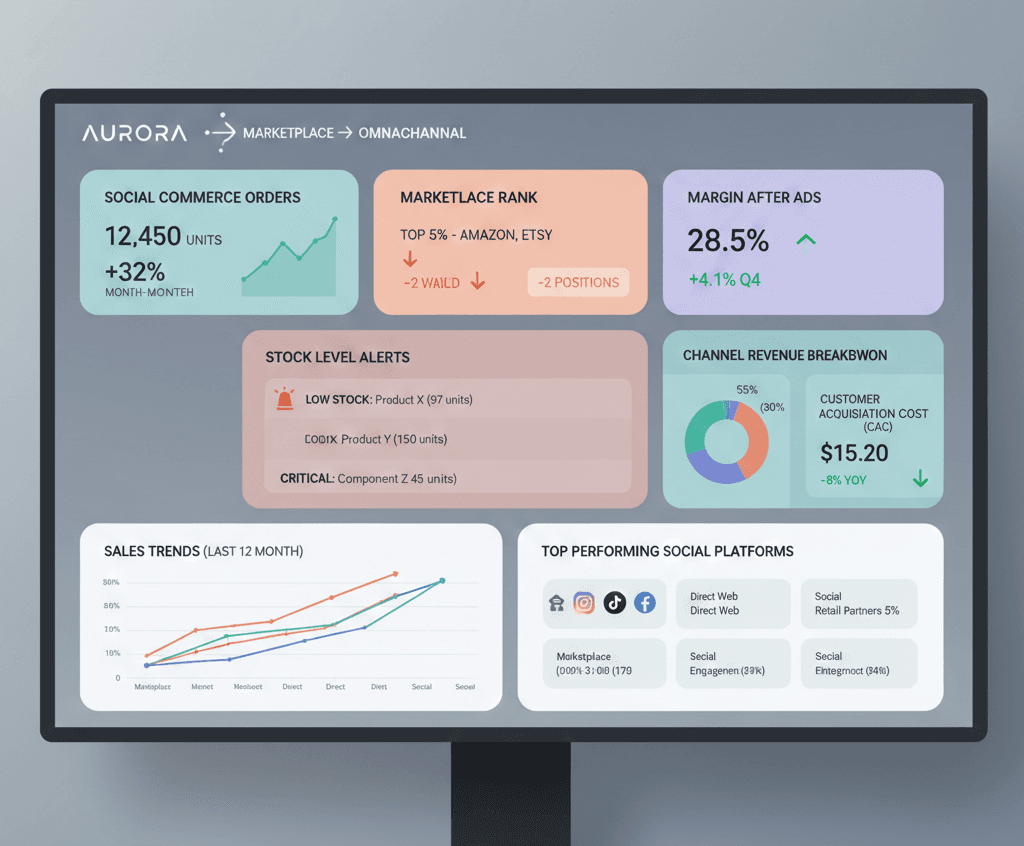

Shoppers increasingly discover products in short video and buy without leaving the app. Brands that treat social commerce as a real storefront, not just an awareness channel, are outpacing peers on both revenue and learning speed. If you are exploring how platforms blend with marketplaces, start with this explainer on cross channel dynamics in Amazon and Social Media Partnerships. It frames why social proof, creator content, and marketplace logistics work best together.

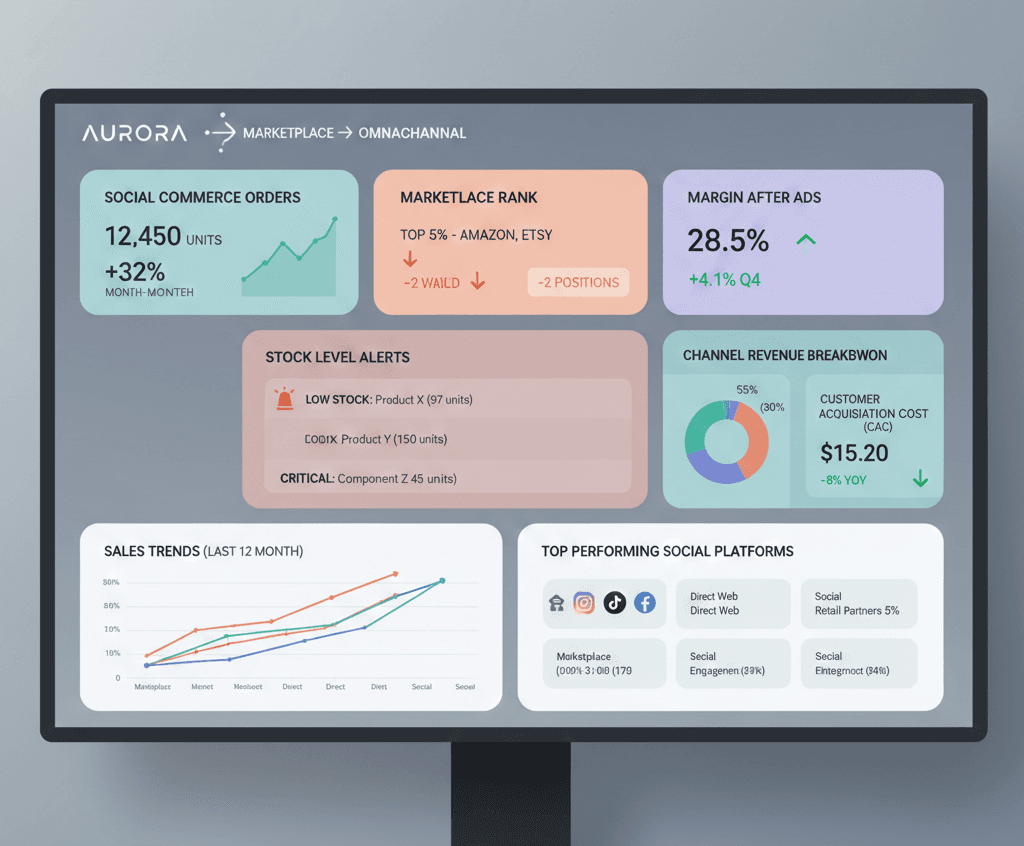

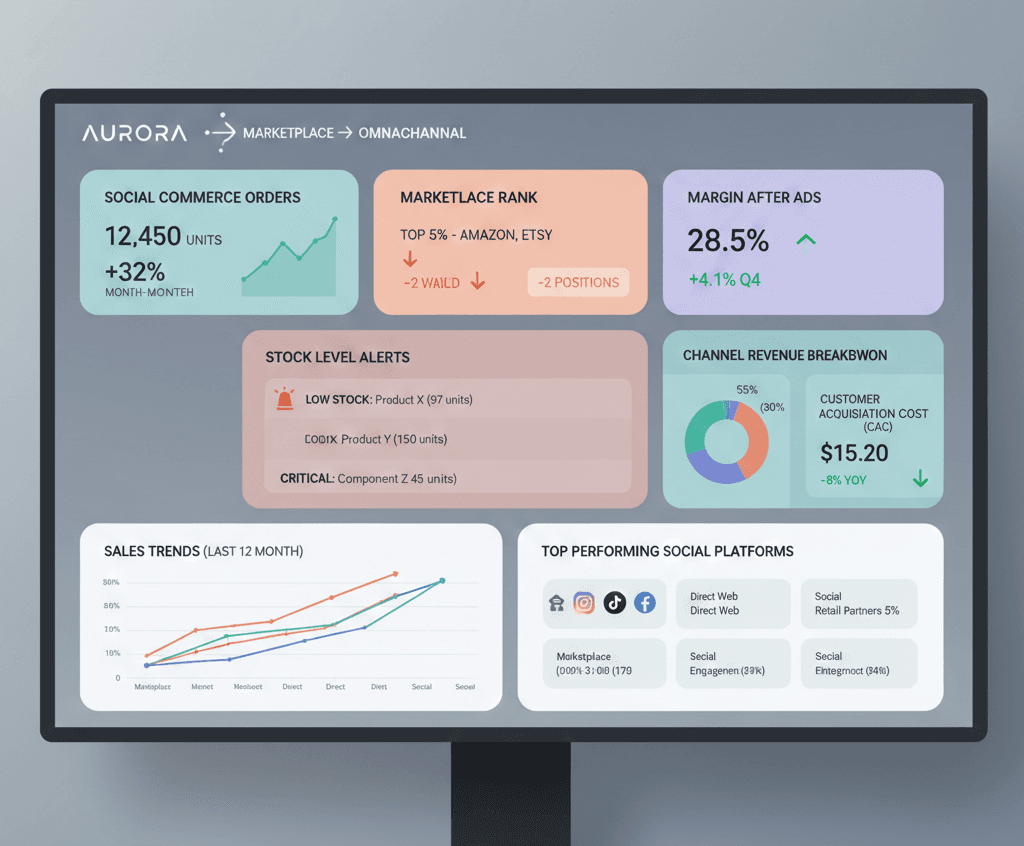

The 90 day plan at a glance

You will stand up a minimum viable storefront on one social platform, protect your marketplace rank with focused ad coverage, and keep inventory tight to avoid long tail dead stock. For a wider context on channel prioritization, read Walmart: Where Should E-commerce Brands Invest?. It shows how to weigh audience reach, fees, and fulfillment speed when you add a new node to your stack.

Days 1 to 14: Clarify the offer and logistics

Pick one hero product that already converts. Build two offer variants that change either price or bundle content. Align fulfillment so delivery speed on social matches your marketplace promise. If you need a refresher on shaping bundles that actually move, this guide on Product Page Optimization is a quick win for messaging hierarchy and proof placement.

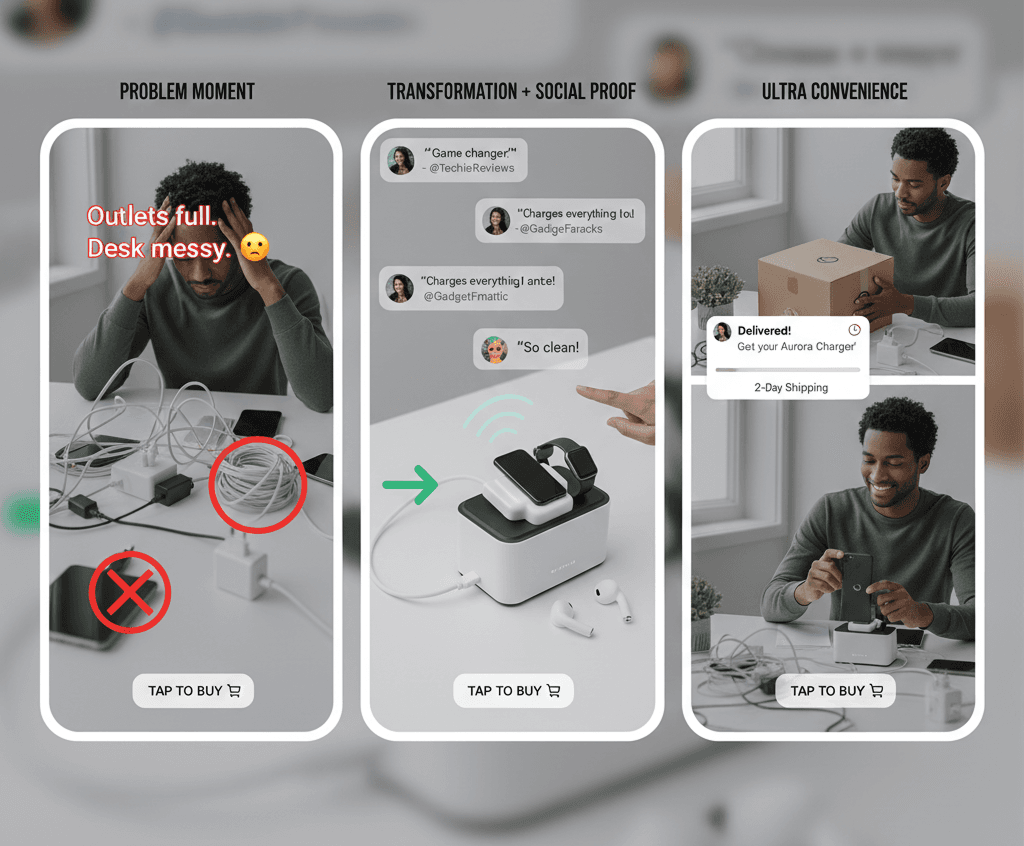

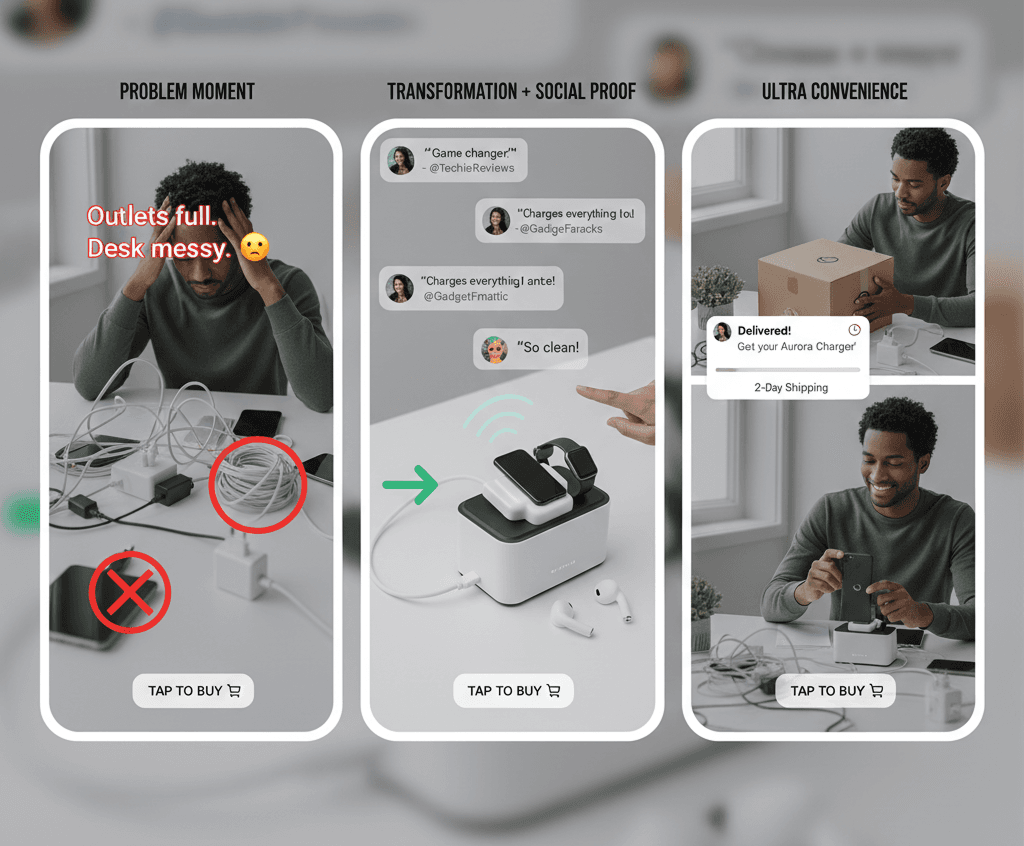

Days 15 to 30: Ship the first shoppable content set

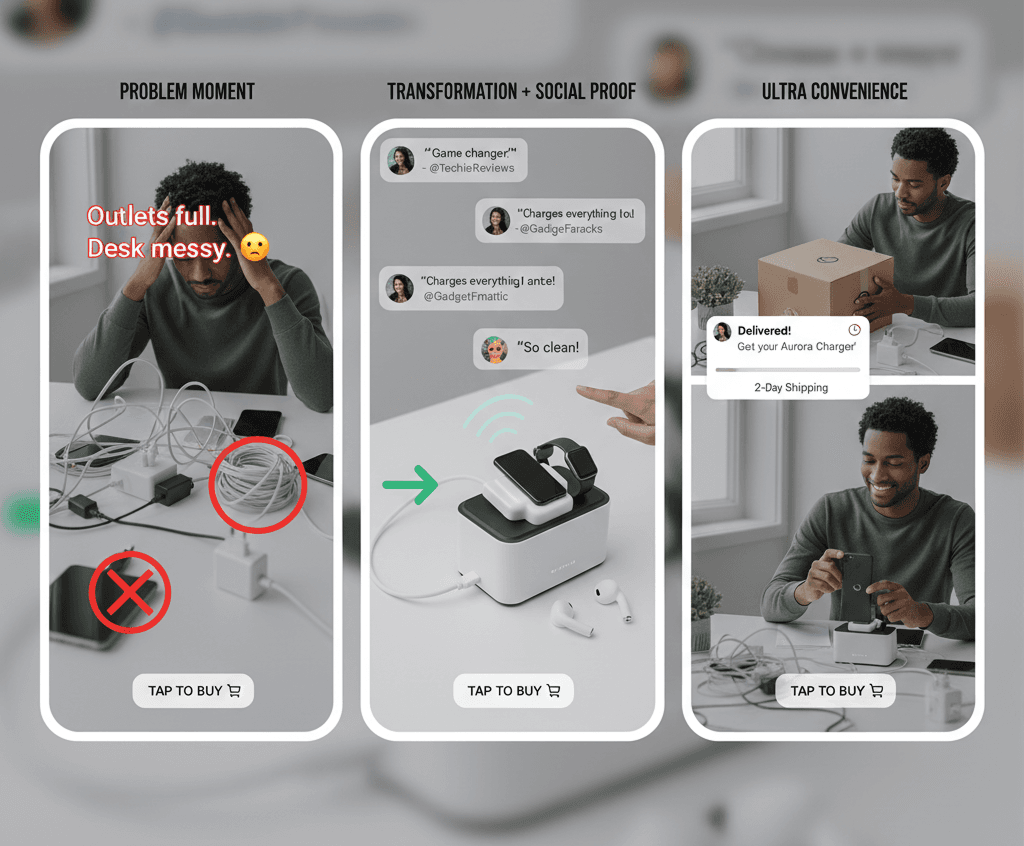

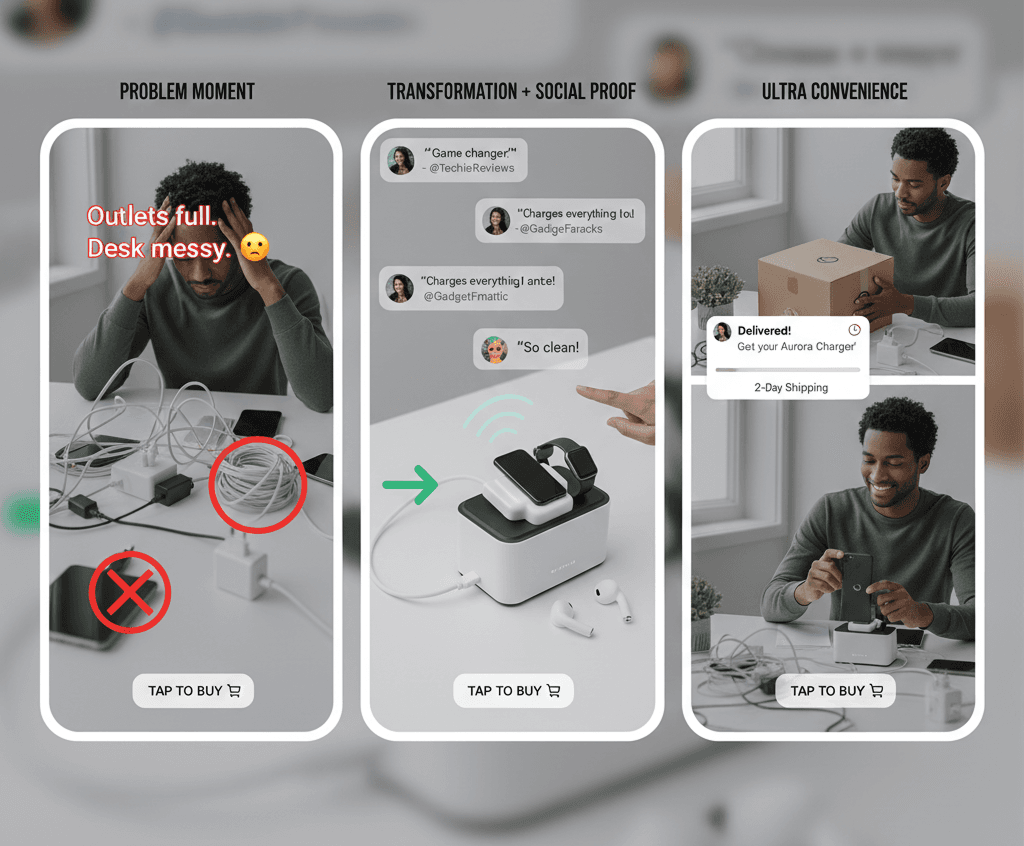

Create three short videos that each spotlight a different buying trigger. One should focus on the problem and solution moment, one on transformation with before and after proof, and one on speed or convenience. Pair the content sprint with basic automation from E-Commerce Marketing Automation so comments, DMs, and coupon requests do not bog down your team.

XENA’s creative testing workflow helps here. The platform rotates variations, watches early engagement and add to cart rate, then pushes budget behind the best performing angles while keeping profit guardrails in place.

Days 31 to 45: Defend marketplace rank while you test

Social wins can cannibalize marketplace velocity if you are not careful. Protect rank by covering your most important keywords with always on ads and by stabilizing price across channels. If rank slips or sessions thin out, pull proven plays from Amazon Ad Optimization and the retention friendly tactics in What is Ecommerce Customer Retention And How To Improve It?.

Days 46 to 60: Tighten targeting and refine the bundle

Use audience insights from your first month to adjust hooks and bundles. If you see strong interest but weak completion, you likely have a trust or friction issue. Refresh copy with benefit first headlines and surface social proof near the call to action. For a deeper personalization angle, pull ideas from How AI Is Redefining Personalization in E-Commerce.

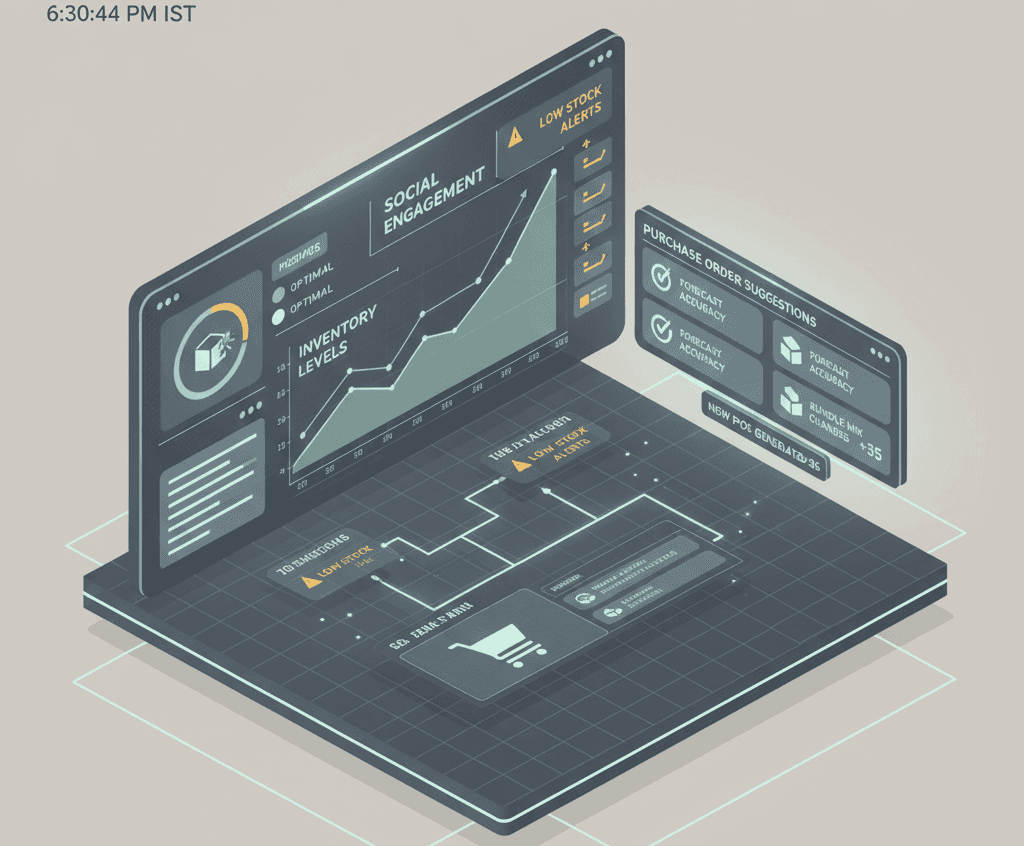

Days 61 to 75: Bring inventory into the conversation

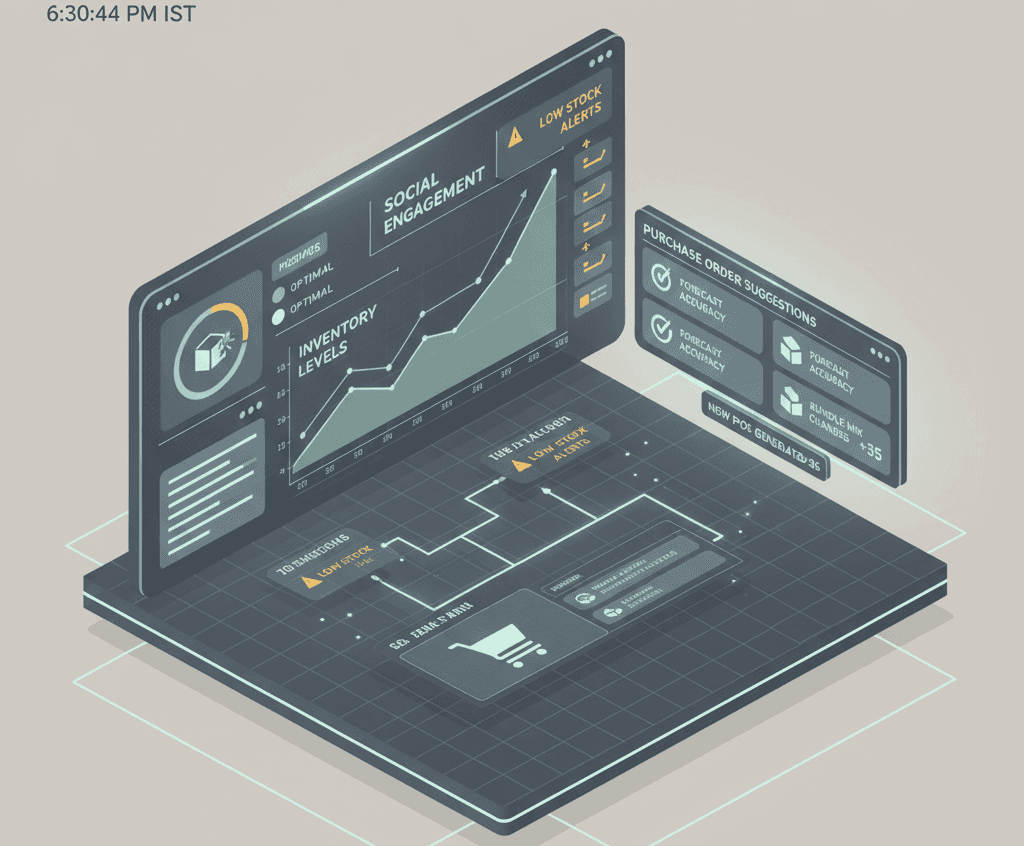

The fastest way to erase social gains is to stock out or overbuy. Forecast demand with tighter windows and reallocate working capital to winners. XENA’s predictive models link signals from social engagement and marketplace velocity to purchase order suggestions so you buy just enough and never miss a spike. For the operating mindset, study Inventory as a Growth Lever in 2026. If you are already carrying too much of the wrong things, use the playbook in What To Do With Unsold Inventory?.

Days 76 to 90: Scale what works and systemize the loop

Double down on your best content pattern and strongest offer. Expand creators carefully and keep pricing consistent. Add lightweight lifecycle messaging so buyers repurchase or upgrade without heavy discounts. For a channel neutral checklist on crafting the page that actually closes, revisit Designing a Winning Amazon Product Page. Then wire your calendar around consistent output with the guidance in Effective Email Marketing Strategies for eCommerce.

XENA’s optimization engine keeps this loop humming. Bids and budgets update hourly across your marketplace campaigns. Predictive analytics flag audiences that are warming up on social before you spend big. Expert assistance is available 24 by 7 so you never stall mid test.

How to choose your next platform after the first 90 days

Once your first social storefront is steady, pick the next move based on inventory capacity and creative bandwidth. If your catalog is replenishable and your creators can produce consistent video, consider a second social channel to multiply proof. If logistics are your edge, consider marketplace expansion where fast shipping and high seller metrics give you instant credibility. For cross platform planning, use the decision frameworks in Should Your Brand Sell on Amazon? and the broader strategy lens in E-commerce Trends for 2024: Facts You Must Know.

The bottom line

Omnichannel growth rewards brands that move quickly but keep discipline. Start with one hero offer. Publish shoppable content that answers real objections. Defend marketplace rank while you experiment. Let inventory math guide your scale decisions. With XENA handling optimization and forecasts, you can spend your energy on creative and partnerships that raise the ceiling on profitable demand.

Why social commerce belongs in your 2026 plan

Shoppers increasingly discover products in short video and buy without leaving the app. Brands that treat social commerce as a real storefront, not just an awareness channel, are outpacing peers on both revenue and learning speed. If you are exploring how platforms blend with marketplaces, start with this explainer on cross channel dynamics in Amazon and Social Media Partnerships. It frames why social proof, creator content, and marketplace logistics work best together.

The 90 day plan at a glance

You will stand up a minimum viable storefront on one social platform, protect your marketplace rank with focused ad coverage, and keep inventory tight to avoid long tail dead stock. For a wider context on channel prioritization, read Walmart: Where Should E-commerce Brands Invest?. It shows how to weigh audience reach, fees, and fulfillment speed when you add a new node to your stack.

Days 1 to 14: Clarify the offer and logistics

Pick one hero product that already converts. Build two offer variants that change either price or bundle content. Align fulfillment so delivery speed on social matches your marketplace promise. If you need a refresher on shaping bundles that actually move, this guide on Product Page Optimization is a quick win for messaging hierarchy and proof placement.

Days 15 to 30: Ship the first shoppable content set

Create three short videos that each spotlight a different buying trigger. One should focus on the problem and solution moment, one on transformation with before and after proof, and one on speed or convenience. Pair the content sprint with basic automation from E-Commerce Marketing Automation so comments, DMs, and coupon requests do not bog down your team.

XENA’s creative testing workflow helps here. The platform rotates variations, watches early engagement and add to cart rate, then pushes budget behind the best performing angles while keeping profit guardrails in place.

Days 31 to 45: Defend marketplace rank while you test

Social wins can cannibalize marketplace velocity if you are not careful. Protect rank by covering your most important keywords with always on ads and by stabilizing price across channels. If rank slips or sessions thin out, pull proven plays from Amazon Ad Optimization and the retention friendly tactics in What is Ecommerce Customer Retention And How To Improve It?.

Days 46 to 60: Tighten targeting and refine the bundle

Use audience insights from your first month to adjust hooks and bundles. If you see strong interest but weak completion, you likely have a trust or friction issue. Refresh copy with benefit first headlines and surface social proof near the call to action. For a deeper personalization angle, pull ideas from How AI Is Redefining Personalization in E-Commerce.

Days 61 to 75: Bring inventory into the conversation

The fastest way to erase social gains is to stock out or overbuy. Forecast demand with tighter windows and reallocate working capital to winners. XENA’s predictive models link signals from social engagement and marketplace velocity to purchase order suggestions so you buy just enough and never miss a spike. For the operating mindset, study Inventory as a Growth Lever in 2026. If you are already carrying too much of the wrong things, use the playbook in What To Do With Unsold Inventory?.

Days 76 to 90: Scale what works and systemize the loop

Double down on your best content pattern and strongest offer. Expand creators carefully and keep pricing consistent. Add lightweight lifecycle messaging so buyers repurchase or upgrade without heavy discounts. For a channel neutral checklist on crafting the page that actually closes, revisit Designing a Winning Amazon Product Page. Then wire your calendar around consistent output with the guidance in Effective Email Marketing Strategies for eCommerce.

XENA’s optimization engine keeps this loop humming. Bids and budgets update hourly across your marketplace campaigns. Predictive analytics flag audiences that are warming up on social before you spend big. Expert assistance is available 24 by 7 so you never stall mid test.

How to choose your next platform after the first 90 days

Once your first social storefront is steady, pick the next move based on inventory capacity and creative bandwidth. If your catalog is replenishable and your creators can produce consistent video, consider a second social channel to multiply proof. If logistics are your edge, consider marketplace expansion where fast shipping and high seller metrics give you instant credibility. For cross platform planning, use the decision frameworks in Should Your Brand Sell on Amazon? and the broader strategy lens in E-commerce Trends for 2024: Facts You Must Know.

The bottom line

Omnichannel growth rewards brands that move quickly but keep discipline. Start with one hero offer. Publish shoppable content that answers real objections. Defend marketplace rank while you experiment. Let inventory math guide your scale decisions. With XENA handling optimization and forecasts, you can spend your energy on creative and partnerships that raise the ceiling on profitable demand.

Why social commerce belongs in your 2026 plan

Shoppers increasingly discover products in short video and buy without leaving the app. Brands that treat social commerce as a real storefront, not just an awareness channel, are outpacing peers on both revenue and learning speed. If you are exploring how platforms blend with marketplaces, start with this explainer on cross channel dynamics in Amazon and Social Media Partnerships. It frames why social proof, creator content, and marketplace logistics work best together.

The 90 day plan at a glance

You will stand up a minimum viable storefront on one social platform, protect your marketplace rank with focused ad coverage, and keep inventory tight to avoid long tail dead stock. For a wider context on channel prioritization, read Walmart: Where Should E-commerce Brands Invest?. It shows how to weigh audience reach, fees, and fulfillment speed when you add a new node to your stack.

Days 1 to 14: Clarify the offer and logistics

Pick one hero product that already converts. Build two offer variants that change either price or bundle content. Align fulfillment so delivery speed on social matches your marketplace promise. If you need a refresher on shaping bundles that actually move, this guide on Product Page Optimization is a quick win for messaging hierarchy and proof placement.

Days 15 to 30: Ship the first shoppable content set

Create three short videos that each spotlight a different buying trigger. One should focus on the problem and solution moment, one on transformation with before and after proof, and one on speed or convenience. Pair the content sprint with basic automation from E-Commerce Marketing Automation so comments, DMs, and coupon requests do not bog down your team.

XENA’s creative testing workflow helps here. The platform rotates variations, watches early engagement and add to cart rate, then pushes budget behind the best performing angles while keeping profit guardrails in place.

Days 31 to 45: Defend marketplace rank while you test

Social wins can cannibalize marketplace velocity if you are not careful. Protect rank by covering your most important keywords with always on ads and by stabilizing price across channels. If rank slips or sessions thin out, pull proven plays from Amazon Ad Optimization and the retention friendly tactics in What is Ecommerce Customer Retention And How To Improve It?.

Days 46 to 60: Tighten targeting and refine the bundle

Use audience insights from your first month to adjust hooks and bundles. If you see strong interest but weak completion, you likely have a trust or friction issue. Refresh copy with benefit first headlines and surface social proof near the call to action. For a deeper personalization angle, pull ideas from How AI Is Redefining Personalization in E-Commerce.

Days 61 to 75: Bring inventory into the conversation

The fastest way to erase social gains is to stock out or overbuy. Forecast demand with tighter windows and reallocate working capital to winners. XENA’s predictive models link signals from social engagement and marketplace velocity to purchase order suggestions so you buy just enough and never miss a spike. For the operating mindset, study Inventory as a Growth Lever in 2026. If you are already carrying too much of the wrong things, use the playbook in What To Do With Unsold Inventory?.

Days 76 to 90: Scale what works and systemize the loop

Double down on your best content pattern and strongest offer. Expand creators carefully and keep pricing consistent. Add lightweight lifecycle messaging so buyers repurchase or upgrade without heavy discounts. For a channel neutral checklist on crafting the page that actually closes, revisit Designing a Winning Amazon Product Page. Then wire your calendar around consistent output with the guidance in Effective Email Marketing Strategies for eCommerce.

XENA’s optimization engine keeps this loop humming. Bids and budgets update hourly across your marketplace campaigns. Predictive analytics flag audiences that are warming up on social before you spend big. Expert assistance is available 24 by 7 so you never stall mid test.

How to choose your next platform after the first 90 days

Once your first social storefront is steady, pick the next move based on inventory capacity and creative bandwidth. If your catalog is replenishable and your creators can produce consistent video, consider a second social channel to multiply proof. If logistics are your edge, consider marketplace expansion where fast shipping and high seller metrics give you instant credibility. For cross platform planning, use the decision frameworks in Should Your Brand Sell on Amazon? and the broader strategy lens in E-commerce Trends for 2024: Facts You Must Know.

The bottom line

Omnichannel growth rewards brands that move quickly but keep discipline. Start with one hero offer. Publish shoppable content that answers real objections. Defend marketplace rank while you experiment. Let inventory math guide your scale decisions. With XENA handling optimization and forecasts, you can spend your energy on creative and partnerships that raise the ceiling on profitable demand.

Why social commerce belongs in your 2026 plan

Shoppers increasingly discover products in short video and buy without leaving the app. Brands that treat social commerce as a real storefront, not just an awareness channel, are outpacing peers on both revenue and learning speed. If you are exploring how platforms blend with marketplaces, start with this explainer on cross channel dynamics in Amazon and Social Media Partnerships. It frames why social proof, creator content, and marketplace logistics work best together.

The 90 day plan at a glance

You will stand up a minimum viable storefront on one social platform, protect your marketplace rank with focused ad coverage, and keep inventory tight to avoid long tail dead stock. For a wider context on channel prioritization, read Walmart: Where Should E-commerce Brands Invest?. It shows how to weigh audience reach, fees, and fulfillment speed when you add a new node to your stack.

Days 1 to 14: Clarify the offer and logistics

Pick one hero product that already converts. Build two offer variants that change either price or bundle content. Align fulfillment so delivery speed on social matches your marketplace promise. If you need a refresher on shaping bundles that actually move, this guide on Product Page Optimization is a quick win for messaging hierarchy and proof placement.

Days 15 to 30: Ship the first shoppable content set

Create three short videos that each spotlight a different buying trigger. One should focus on the problem and solution moment, one on transformation with before and after proof, and one on speed or convenience. Pair the content sprint with basic automation from E-Commerce Marketing Automation so comments, DMs, and coupon requests do not bog down your team.

XENA’s creative testing workflow helps here. The platform rotates variations, watches early engagement and add to cart rate, then pushes budget behind the best performing angles while keeping profit guardrails in place.

Days 31 to 45: Defend marketplace rank while you test

Social wins can cannibalize marketplace velocity if you are not careful. Protect rank by covering your most important keywords with always on ads and by stabilizing price across channels. If rank slips or sessions thin out, pull proven plays from Amazon Ad Optimization and the retention friendly tactics in What is Ecommerce Customer Retention And How To Improve It?.

Days 46 to 60: Tighten targeting and refine the bundle

Use audience insights from your first month to adjust hooks and bundles. If you see strong interest but weak completion, you likely have a trust or friction issue. Refresh copy with benefit first headlines and surface social proof near the call to action. For a deeper personalization angle, pull ideas from How AI Is Redefining Personalization in E-Commerce.

Days 61 to 75: Bring inventory into the conversation

The fastest way to erase social gains is to stock out or overbuy. Forecast demand with tighter windows and reallocate working capital to winners. XENA’s predictive models link signals from social engagement and marketplace velocity to purchase order suggestions so you buy just enough and never miss a spike. For the operating mindset, study Inventory as a Growth Lever in 2026. If you are already carrying too much of the wrong things, use the playbook in What To Do With Unsold Inventory?.

Days 76 to 90: Scale what works and systemize the loop

Double down on your best content pattern and strongest offer. Expand creators carefully and keep pricing consistent. Add lightweight lifecycle messaging so buyers repurchase or upgrade without heavy discounts. For a channel neutral checklist on crafting the page that actually closes, revisit Designing a Winning Amazon Product Page. Then wire your calendar around consistent output with the guidance in Effective Email Marketing Strategies for eCommerce.

XENA’s optimization engine keeps this loop humming. Bids and budgets update hourly across your marketplace campaigns. Predictive analytics flag audiences that are warming up on social before you spend big. Expert assistance is available 24 by 7 so you never stall mid test.

How to choose your next platform after the first 90 days

Once your first social storefront is steady, pick the next move based on inventory capacity and creative bandwidth. If your catalog is replenishable and your creators can produce consistent video, consider a second social channel to multiply proof. If logistics are your edge, consider marketplace expansion where fast shipping and high seller metrics give you instant credibility. For cross platform planning, use the decision frameworks in Should Your Brand Sell on Amazon? and the broader strategy lens in E-commerce Trends for 2024: Facts You Must Know.

The bottom line

Omnichannel growth rewards brands that move quickly but keep discipline. Start with one hero offer. Publish shoppable content that answers real objections. Defend marketplace rank while you experiment. Let inventory math guide your scale decisions. With XENA handling optimization and forecasts, you can spend your energy on creative and partnerships that raise the ceiling on profitable demand.

Trending Blogs

Creative Fatigue in PPC: How to Maintain Ad Performance in 2026

Creative Fatigue in PPC: How to Maintain Ad Performance in 2026

Creative Fatigue in PPC: How to Maintain Ad Performance in 2026

Creative Fatigue in PPC: How to Maintain Ad Performance in 2026

The 2026 Amazon PPC Growth Stack: Creative speed, profit control, and hourly optimization

The 2026 Amazon PPC Growth Stack: Creative speed, profit control, and hourly optimization

The 2026 Amazon PPC Growth Stack: Creative speed, profit control, and hourly optimization

The 2026 Amazon PPC Growth Stack: Creative speed, profit control, and hourly optimization

Win December on Amazon: A Last-Mile Playbook for Holiday Sales

Win December on Amazon: A Last-Mile Playbook for Holiday Sales

Win December on Amazon: A Last-Mile Playbook for Holiday Sales